More than a few people heard that distinctive sound several days before Christmas in 2017. It was a kind of spasm in the online ectoplasm, almost audible in the real world over the snowy silence of December 22nd. On that day, the great cryptocurrency bubble violently deflated as the price of one bitcoin ran from $20,000 to $10,500. In the immediate aftermath, the market seemed to recover, coming close to its all-time highs. After that, however, it became a vicious bear market, the mirror inverse of its previous bull market, losing 70 percent of its value in just months.

It’s worth stepping back and asking why this has happened. Why was the price of one bitcoin $20,000 in December but $6,000 the summer of 2018?

Is the answer as simple as labeling it a bubble? For those who weren’t paying attention to the insanity that was the 2017 cryptocurrency market, consider how amazing it is that during any particular day in 2017—it could be a day without any remarkable weather; unmemorable in every other conceivable way — there were people making and losing fortunes, experiencing agony and ecstasy, all through the portals of their screens. What were normal days for you might have been heaven or hell for them.

Now it’s happening again, in the Spring of 2021.1 But beyond the hysteria and madness of the markets, to truly understand Bitcoin’s meteoric rise and fall, and now rise again, one has to understand something about the underlying technology, since a big part of it is likely related to how novel the Bitcoin protocol is.

There is a fundamental alienness to Bitcoin, which is amplified by the sheer scale of what it’s trying to accomplish. At this point it’s not far-fetched to say these entities, these cryptocurrencies, are the most interesting technological objects of the millennial generation. They are futuristic even for our futuristic times. In learning about them you are thrust into a tumbling wonderland where a thing most familiar and indispensable, money itself, is being interrogated.

Bitcoin As Hyperobject

The philosopher Timothy Morton uses a term to describe “events or systems or processes that are too complex, too massively distributed across space and time, for humans to get a grip on.” He calls such things hyperobjects. Morton goes on to say that

black holes are hyperobjects; nuclear materials such as uranium and plutonium, with their deep-time half-lives, are hyperobjects; global warming and mass species extinction are hyperobjects. We know, we live with, the local effects of these phenomena, but mostly they are quite literally beyond our ken.

Bitcoin is such a hyperobject, the first of its kind. Bitcoin expands across spacetime, a growing chain of ordered megabyte blocks, both everywhere and nowhere. Its fluid physical manifestations sprout up to gobble up cheap electricity, frigid warehouses stacked with buzzing thermodynamical demons solving computational puzzles that exist only to play a guessing game that is purposefully pointless. Input/output ports, like exchanges, or peer-to-peer sales, or accepting merchants, reach upward like tendrils from this ineffable otherworld where Bitcoin really exists. People in the community call the Bitcoin protocol “the honey badger” because it simply will not die. All this from a distributed ledger no more complicated in its contents than an Excel document.

Those contents — the information on them — also mark it as a hyperobject. Like other hyperobjects, blockchains violate normal rules and transcend old paradoxes. For instance, some philosophers of mind have wondered how a physical object like the brain can contain information that isn’t read-out subjectively by an observer. But the information contents of blockchains seem fundamentally fixed and definite in a way most other information is not. The distributed ledger composed of wallets and their holdings has a particular consensus — it is agreed upon by all — and this consensus is enforced by proof-of-work. Perhaps one fanciful hypothesis is that the brain itself works kind of like an organic blockchain, replicating its model of self and world across its hemispheres and modules, with consciousness being the current decentralized neural consensus of the state of that model.

Even the actual value of an individual bitcoin denotes the protocol as a hyperobject. Its duality is fascinating. Unlike the objectively real information in a distributed ledger, the value of that ledger is totally subjective. A stack of accounts isn’t meaningful unless the real world follows along. In this, paradoxically, the success of Bitcoin hinges on its own success. If the entire Bitcoin protocol is valued as the #1 currency in the world, it will have such an insanely high market cap that the intra-day volatility will necessarily be low. Low volatility is what is required for a usable currency. So the higher the market cap of Bitcoin gets, the more usable it becomes for purchases and pricing, and this is again the sort of ouroboros-like loop that signifies a hyperobject.

For the sake of further argument, let’s assume that the ultimate dream of Bitcoin works out (I don’t mean to imply here that it’s a foregone conclusion). In this dream, Bitcoin ends up replacing the U.S. dollar as a global reserve currency and as a global repository of value. For those who think this is crazy, Bitcoin was briefly in the top 20 world currencies in 2017 in terms of total value stored. Now, during this bubble, it has reached the #3 currency in the world, according to Deutsche Bank.

At the number 1 spot, an individual bitcoin might be worth something like $300,000 to $500,000 — perhaps even millions.

At first glance, such a suggestion might seem absurd. How can abstract unit of currency have value like that, especially something so recent and so untested? Yet isn’t money itself like that?

Money is a socially constructed unit of measurement. It is a yardstick; a ruler. But measurement works both ways. So we can instead label objects like cars and houses and computers the measuring devices, making money instead the object of real value. If we went with this latter view, money would be construed as value itself. So when someone creates a new and superior form of money, and it turns out that what we previously meant by “money” needs to shift to this new form, then its value is just all the old money.

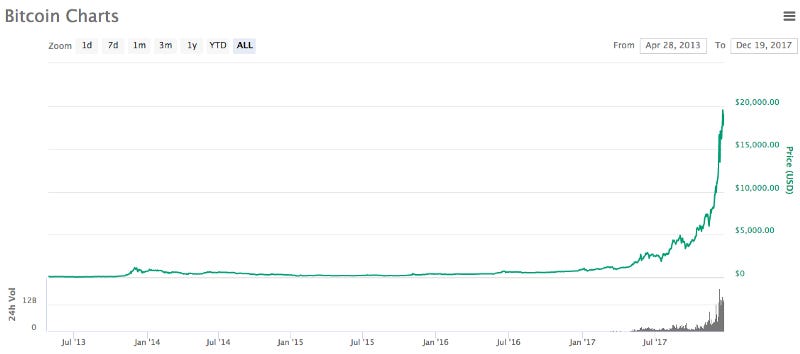

And correspondingly, in its price action there’s a fundamental enormousness to Bitcoin that marks it as a hyberobject. It’s like we can’t quite get the thing in focus. Up close, on a daily level, there was immense volatility in the price last year (up 15 percent one day, down 10 percent the next). Then, zooming out, there were also longer monthly volatility cycles. Bitcoin would go up to $3,000, then, the next month, drop down to $1,800, etc. Yet even as these cycles spun out over time, the direction was always and inevitably up. Here’s what this rather astounding process looked like the day before the crash.

But one can zoom out even further. And from the perspective of cycles with cycles, the current negative price action looks no more mysterious than the process whereby a bitcoin can run up 15 percent one day and then lose 10 percent the following day. From this distance, the daily and monthly peaks and troughs can be conceptualized as Ptolemaic epicycles within the grand cycles that play out on the yearly basis (sometimes even every two or three years). Quite simply: There is no way to get from immensely low prices to immensely high prices in a straight line, even if everyone involved believed strongly that the outcome was preordained.

A recent paper by a number of interdisciplinary researchers analyzed the boom and bust of Bitcoin, putting a mathematical spin on the same general idea of cycles. Their assumption, which is probably overly simplistic, is that the value of Bitcoin is derived (entirely) from Metcalfe’s law, which states that the value of a system is proportional to the number of connected users squared (n²). Yet the price often gets ahead of itself, and in fact during a classic Bitcoin bubble the price begins to move super-exponentially, as if Bitcoin was striving to reach its teleological end state of world currency from whatever lowly point it’s at in a single instant, and then inevitably collapses back upon itself, since singularities are outlawed in the real physical world. Wings of wax melt along with billions.

This same behavior has also been described as Bitcoin having a fractal nature, where it ramps through bubbles and then pops.

Ultimately, I’m not especially concerned with the mechanisms behind this behavior. Perhaps it’s best represented as fractals, perhaps as singularities, but either way, both fit what I consider the real superordinate cause: the volatility along the path of an asset going from a price of one cent to trying to replace money itself is literally beyond human cognitive capabilities and timescales.

Here is a chart by Willy Woo in 2021, using more recent on-chain metrics, that agrees with this analysis that the bubbles are basically just the short term epicycles in a larger adoption curve:

Will The Bubble Pop—Or Envelop Us All?

What will happen in the end? Maybe the decade of Bitcoin’s life will all amount to nothing, and go down as one of the largest mass delusions in history. But I have my doubts. There is simply too much energy, intellectual and economic, now behind it. The internet started as a way of sending information across distant computers. It ended — or, rather, has continued — with social media reshaping our society, for both good and ill.

Cryptocurrencies started as a way of sending money across distant computers. How will it end? How will it reshape our society, if indeed it does?

It is possible the answer is already being built. A blockchain is both an asset but also a community of addresses interacting with each other. The combination of money and community demands a form of proto-government. Is it really so farfetched to think that in the future government itself might be similarly interrogated by this technology? If blockchains solve a lack of trust, and were kicked off by the loss of trust in the banking system due to the financial crisis of 2008, isn’t there a similar lack of trust waiting to be colonized in the realm of government?

I’m not talking about incremental forms of assistance, such as recording votes on the blockchain; I’m talking about a direction that is still embryonic, but mature enough to suggest incredible possibilities, especially in some of the newer Bitcoin-like projects. This is the idea of a “digital commonwealth” which self-governs its technological and economic evolution, as well as laws and community standards. These digital commonwealths make it clear that the power of blockchains is not to completely eliminate trust, but rather to formalize it.

If I had to place a radical bet on a black swan reshaping our world by the time I’m older, I’d pick the neotenous toddling forms of crypto-governance. I don’t think it’s an unreasonable stab at the future to imagine that in a few decades there could effectively be a global crypto-neocameralism built atop the increasingly irrelevant foundations of nation states.

Which gets to why this stuff is so interesting. Because despite appearances, there is surprisingly little that is new in this age. Some people think the world is changing a great deal, but beyond the small screens in our pockets, our infrastructure and culture are surprisingly close to stagnation. Big Tech still makes most of its money selling advertising. Movies are now mostly re-makes. Video games get better graphics but worse writing. Even last century’s great political debate, between capitalism and communism, is playing out all over again, but with demographics swapped in for classes. Humans are the same as they ever were.

So give me hyperloops and rockets! Give me Martian colonies! Give me radical new forms of governance! Let a thousand flowers bloom as we try novel forms of economic communities instead of repeating old mistakes. Give me positronic brains and artificial intelligence! Give me blockchains and dApps and new markets that anyone in the world can participate in. Please. I’d like the 1988 world I was born into firmly in the past when I die, just so that, at the end, I can say I truly saw one century pass into another.

Note: this was originally published in 2017 on another platform, it has now been updated and published on substack in April 2021 to reflect current events and new on-chain measurements.

Erik - I’m glad to have stumbled across your newsletter, I’d never read anything on substack before. I ended up reading 3 of your essays + subscribing. You’re an incredibly talented writer — looking forward to reading more.

I'd rather opt for the notion of "hyper-structure" by Jacob rather than Björkesque blurriness of Tim's reconception of Lovecraftian calisthenics of the mind. 2 years flashforward, as I am arriving from the future under this piece, I think what now matters are mechanism markets that are about to go full force when it comes to fat protocols, programmable privacy by means of confidential data storage and availability across precompiled remixes unto the Ethereum Virtual Machine. It would be wise to follow those who try to maintain network resilience by means of censorship resistance by hedging against profit maximalism.

https://jacob.energy/hyperstructures.html

Also, check the latest Flashbots experiments.